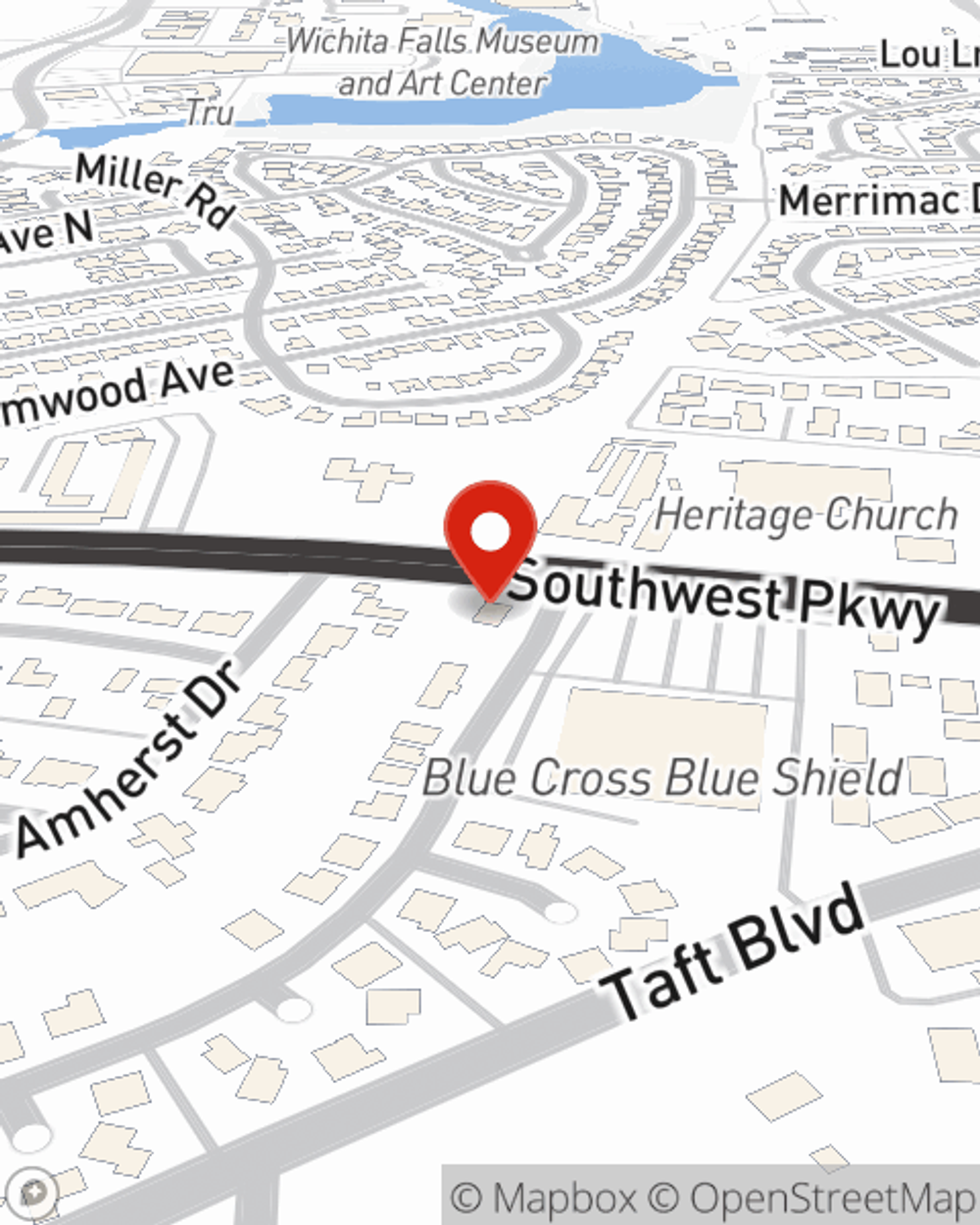

Business Insurance in and around Wichita Falls

Get your Wichita Falls business covered, right here!

Insure your business, intentionally

State Farm Understands Small Businesses.

You've put a lot of elbow grease into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a lawn care service, a HVAC company, a toy store, or other.

Get your Wichita Falls business covered, right here!

Insure your business, intentionally

Small Business Insurance You Can Count On

The passion you have to be a leader in your field is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Mike Morris. With an agent like Mike Morris, your coverage can include great options, such as commercial liability umbrella policies, business owners policies and commercial auto.

The right coverages can help keep your business safe. Consider contacting State Farm agent Mike Morris's office today to discover your options and get started!

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Mike Morris

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.